Carbon Offset Market Opens to Small Southern Timberland Owners

Here is a good article about using carbon credits to encourage private landowners to engage in better forestry practices.

While most carbon credits are environmentally and economically dubious, if we insist on these subsidies, let’s direct them towards holistic practices that reduce fire hazards while improving soil fertility.

NOTE: this article was originally published to WSJ.com on August 1, 2023. It was written by Ryan Dezember.

Commodity trader Mercuria to buy credits produced by BP’s Finite Carbon

One way to generate carbon offsets is forgoing wood harvests so that trees can keep sucking carbon dioxide from the atmosphere.

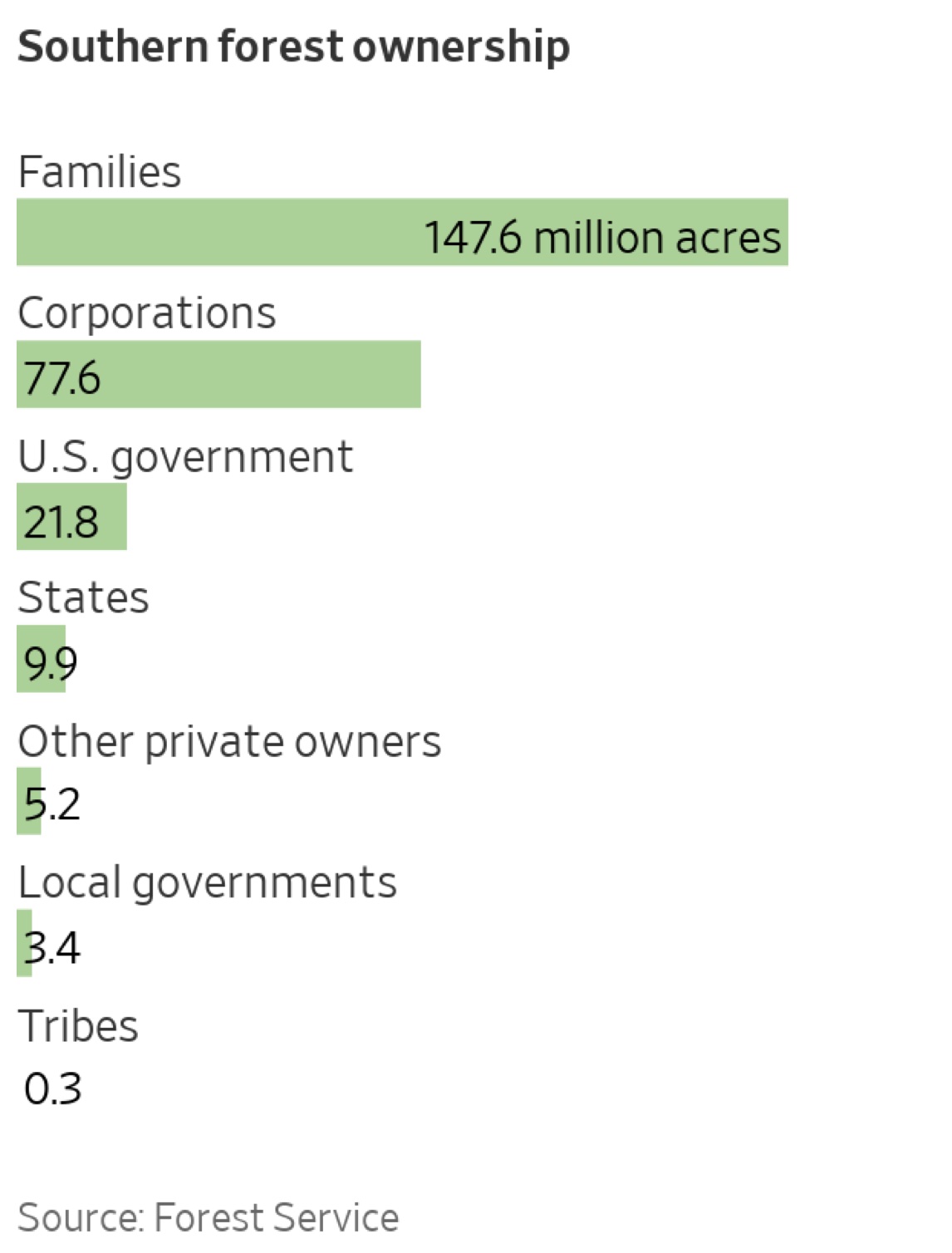

One of the country’s largest forest-carbon firms is launching a platform to enable Southern-timberland owners to sell carbon offsets on properties as small as 40 acres, expanding a market that has mostly been limited to owners of vast wooded tracts.

Finite Carbon, which is majority owned by energy giant BP, said it would begin this month to enroll landowners in 13 Southern states in the program. Landowners will be paid quarterly if they agree to not cut down trees for 20 years and then maintain a steady volume of standing timber on their property for another two decades. The trees must be big enough to be salable at the time the no-cut contract is signed.

Finite has arranged more than $900 million of forest-carbon deals for large U.S. landowners such as timberland investment firms, conservation groups and tribes, dispatching foresters to remote woodlands to measure trees and calculate how much carbon is held on properties that are tens of thousands of acres.

That is only economical for big tracts, so Finite is using Forest Service data, satellite imagery and computer programs to determine how many offsets smaller landowners can sell if they promise not to cut, said Finite Chief Executive Sean Carney.

Mercuria Energy Group agreed to buy the offsets through a Tennessee startup that the Swiss commodities trader backs called LandYield. Mercuria plans to hold some of the forest credits—each representing a metric ton of sequestered carbon—to offset emissions generated by its fossil-fuel businesses and to sell the rest to other companies looking to reduce their own carbon footprints, said Josh Fain, LandYield’s director of operations.

“We are convinced that private, nonindustrial landowners have a significant role in both mitigating climate change and in fostering the long-term health of U.S. forests,” said Enric Arderiu, Mercuria’s global head of environmental products.

There are several ways to generate carbon offsets, which are awarded for reducing greenhouse gases, such as capturing methane emissions from dairy barns and mines. The most popular in the U.S. are associated with forgoing wood harvests so that trees can keep sucking carbon dioxide from the atmosphere as they grow.

Forest offset guidelines developed by regulators in California for the state’s cap-and-trade emissions market have spread to unregulated markets. Firms such as Finite broker so-called voluntary offset deals between landowners and companies that have promised to cut or make up for emissions.

Wall Street firms, such as T. Rowe Price Group’s Oak Hill Advisors and J.P. Morgan Asset Management, have made some of the largest timberland purchases in recent years with an eye toward producing carbon offsets, not wood products.

Even the country’s biggest lumber producers are crunching numbers to see where they can earn more by reducing logging and selling offsets. Weyerhaeuser CEO Devin Stockfish said last week that America’s most prolific logger expects to sell 30,000 offsets this year against some of its timberlands in northern Maine at more than $20 apiece. Weyerhaeuser is planning two more offset projects in the Southeast.

There have been other efforts to bring the South’s thousands of individual timberland owners into the offset market.

NCX, bankrolled by Salesforce.com CEO Marc Benioff and others, in 2021 facilitated payments from companies including Microsoft and Shell to timberland owners who agreed to defer logging for one year. But subsequent offerings were stalled after a carbon-standards organization said last year it wouldn’t approve NCX’s methodology.

The American Carbon Registry, another offset vetting group, approved Finite’s small-tract methodology in 2021. “The carbon gains we think are really clear,” LandYield’s Fain said.

Finite embarked in 2019 on plans for a platform where owners of between 40 acres and 5,000 acres could find their property, circle where they wanted to sell offsets and get an instant estimate of the payments.

It started by using computers to compare the government’s forest inventory with satellite images, locating pixels that matched one of the thousands of plots surveyed by the Forest Service, Finite’s Carney said. Next, Finite’s data scientists made programs to simulate clear cuts on every wooded property, using each state’s logging rules to determine which trees could be cut and which couldn’t, such as along streams.

We basically had to map everything in advance and then develop a carbon project for the entire Southeast,” Carney said. “We’re taking a cookie cutter and putting it on that, but the dough is already all rolled out.”

Once landowners sign up, they must attest periodically that the trees are still standing. Finite will check quarterly using a program it patented earlier this year to detect changes in the forest using satellite imagery.

Mercuria and LandYield have agreed to pay $11 an offset for the first three years, Fain said. Thereafter market pricing will dictate payments. He estimated landowners could earn between $30 to $40 per acre a year.

—

For more posts like this, in your inbox weekly – sign up for the Restoring Diversity Newsletter